Low Cost Auto Insurance in Okeechobee, FL

Auto Insurance to fit your budget & needs

ACCURATE INSURANCE ... Your One-Stop Shop

Call or Text: 863-357-1707 or Toll Free: 866-536-2070

|

Let Us Take the Hassle Out of Getting the Lowest Car Insurance Rates

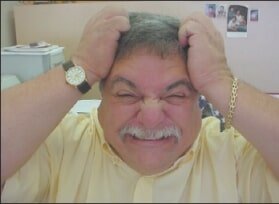

Don’t go insane by paying too much for auto insurance. Accurate Insurance Services can take the pressure off of you. It just takes one call to Accurate Insurance Services at 863-357-1707 to see how much we can help save you on your auto insurance today! |

|

Drive with Confidence: Your Ultimate Auto Insurance Ally

In a world where the unexpected is just around the corner, auto insurance isn’t just a legal necessity—it’s your financial safeguard. But not all insurance is created equal. It’s not just about finding the lowest price; it’s about finding the right protection that stands tall when you need it most. Why Settle for Less When You Can Have the Best? Our agency isn’t just another insurance provider. We’re your local shield against life’s unforeseen turns. From fender benders to major collisions, we ensure that issues like deductibles, rental vehicle access, and uninsured motorists don’t turn into roadblocks on your journey. Tailored Protection That Moves with You Whether you’re a solo driver or steering a full fleet, our dedicated team is committed to crafting policies that fit like a glove. We believe in premium protection without the premium price tag, offering you peace of mind that’s as affordable as it is reliable. Ready for an Upgrade? If your current policy feels more like a spare tire than a safety net, it’s time for a change. Let us review your coverage and introduce you to the latest, most comprehensive options on the market. Your Local Agent: Your Personal Navigator With us, you’re never just a policy number. You have a name, a story, and a local agent ready to guide you. We’re here to decode the fine print, to find you the finest coverage at the fairest rate, and to be your trusted partner in all things auto insurance. Take the Driver’s Seat with Assurance Call us today and experience the difference personalized care makes. With our agency, you’re not just insured; you’re assured. Let’s navigate the roads of life together, protected and prepared for whatever lies ahead. 🚗💼 |

|